This is Part 2 of a two-part interview with Brad Blair, ISRU and lunar mining researcher. We are discussing Blair’s 2002 paper entitled “Space Resource Economic Analysis Toolkit: The Case for Commercial Lunar Ice Mining.” Get your copy

here.

In

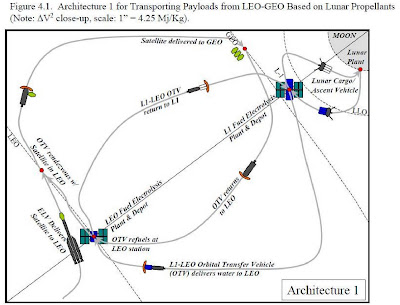

Part 1 of this interview, Brad discussed two architectures his team considered for lunar mining. In Part 2 we discuss lunar ice, nuclear vs. solar, Blair’s economic model used in paper, changes since 2002, how SpaceX has affected the business case for lunar mining and more. The images used in this blog post are from the Paper referenced above and used with permission from Brad Blair.

Q. Your baseline business case assumes 1% ice in the lunar regolith (page 34). How has recent scientific discoveries about the moon affected this assumption?

Brad Blair: The business case closed at 2% ice (note that this was one of four primary feasible conditions that caused the case to close). We ran sensitivity analysis and there is a knee in the curve starting at 0.5% and ending around 4% - see Figure 4.8 in the report. The explanation for this is that more mining and hauling equipment is needed for lower concentrations of ore, necessitating higher capital investment in the mining plant mass in order to meet productivity requirements. Above a certain concentration however other constraints tend to dominate, reducing the beneficial influence of higher ore grade or percent ice. The primary constraint above 4% ice for example is the power system mass needed to run the electrolysis system (which is needed to convert the water into hydrogen and oxygen for enough propellant to boost the payload off the lunar surface and toward the first propellant depot).

Recent scientific discoveries are of course very helpful to the business case. Turns out the ice is likely much greater than 4%, and may even approach 100% in localized high-grade zones. That does simplify the production model a bit, and will clearly have a positive effect when it is time for the engineers to design the details of the lunar surface facilities. One other aspect is the recent discovery of evidence that nitrogen and carbon ices may also exist. For human habitation Nitrogen becomes an important element due to its buffering effect for the air we breathe. It simplifies a lot of life support issues because it is well understood here at home. For long term habitation, a pure oxygen environment is problematic and other buffering gases can cause problems. Carbon opens up a lot of possible secondary products such as liquid storable hydrocarbon fuels like kerosene. It also could be used for manufacturing plastics or other organic chemicals needed for industrial uses.

However we desperately need to verify the remote sensing geophysics with ground truth. Geophysicists will admit to you that there is a given amount of uncertainty in their conclusions due to measurement taken from orbit. While we know a lot about specific equatorial lunar conditions due to the Apollo missions, the "ground truth" available to calibrate spacecraft sensors at those locations is not applicable to polar sites due to extreme environmental differences.

A RTG-powered surface rover mission in a lunar polar crater is a critical next step in proving technical and economic feasibility. Note that the first surface rover could provide sufficient ground truth to begin the harvesting of much more detailed understandings from the existing polar spacecraft data sets. LCROSS is a prime example of this.

Q. To power your lunar mining facility you baselined nuclear power but were considering a new generation of solar power as well. What is your current preferred lunar power source and why?

Brad Blair: Nuclear power is the key to steady-state mining and mineral processing operations. The reason for this is that other that wear & abrasion, most of the problems with mining equipment happen when the equipment is turned off and then back on. For equipment operating in locations that are only 25 Kelvin this will likely be exacerbated, especially since engineers currently like to design spacecraft components to operate at laboratory temperatures. Electronic systems are particularly hard hit when they are cooled to that level and then re-heated (thermal stresses in a complex array of materials tend to cause components to pop out of circuit boards for example).

The simplest solution is to keep things warm of course. That requires a steady source of power. For rover missions that means using an RTG. The Mars Science Lander mission will be able to operate day and night because it has an excellent power source.

In order to make solar power work at the same level of robustness and availability, batteries are required that are sized to survive the night. Even the best locations on the Moon have significant periods of shadow, thus the mass of the batteries quickly becomes the dominant constraint. Add to that the requirement to somehow get the power into permanent shadow and technical risk goes exponential due to systems complexity. In order to make solar power work for a mining plant inside a permanently shadowed crater it will require extending the current technology envelope with a number of serial breakthroughs. Nuclear power plants for space have a long heritage (especially considering the Russian experience) and actually work better in cold conditions.

Having said all of that, solar power does have an upside potential due to the potential for geometric growth under the conditions of in-situ production. Alex Ignatiev of the University of Houston has figured out a way to make low-grade solar cells using 99.9% lunar materials.

I would consider nuclear power the best baseload supply option and use in-situ solar for peak power while the sun is shining.

Q. Describe the excel tool used in much of your analysis. Is this a tool you developed? If starting over would you use Excel again or would you recommend an alternate tool? What were the pros and cons of using this Excel?

Brad Blair: The benefits of developing a spreadsheet-based modeling tool is that it is simple, transparent and the software to run it is accessible to most people. Given the overall simplicity of the math, spreadsheets are the most common tool used for financial analysis. Plug-ins can be purchased for decision analysis, Monte-Carlo simulation, econometric statistical analysis or other higher mathematical functions. It is also relatively straightforward to set up linear or integer programming optimization models using the tools within a typical spreadsheet. The cost modeling was done using NAFCOM under a license granted through the NASA contract.

From the perspective of the parametric engineering model, interconnected spreadsheets offer a simple and transparent way to model linear or geometric behavior for estimating mass and power requirements based on unit mass and power assumptions made by selecting appropriate analogies. Detailed design would of course take advantage of the great strides made in the last 20 years in modeling and simulation of the physical, chemical, thermal and electrical behavior of materials and integrated systems. Many tools are available for this today including a growing library of open-source code. I spent some time in the real-time simulation world and the tools there are amazing, considering the fact that they can leverage dedicated parallel real-time graphics or physics processing units (GPUs or PPUs) paid for by the gaming industry.

Q. Have any entrepreneurs shown interest in turning your analysis into a lunar venture?

Brad Blair: Yes. However I have signed a confidentiality agreement, and am not at liberty to disclose the details.

Q. What has changed since this 2002 analysis to make your lunar mining business case more attractive to investors?

Brad Blair: There are much higher lunar resource grades than previously expected, a wider variety of ores and a greater confidence in the geologic models due to recent lunar missions than at any time in the past. In addition, the steady migration of silicon valley capital and entrepreneurs into the space world provides a much broader base for the emergence of new space markets – the key to a sustainable set of interlocked enterprises that will steadily develop the space frontier for human settlement and commerce. Finally, steady progress in new technologies has been made by NASA, the aerospace industry and international partners, demonstrably lowering costs as evidenced by SpaceX among many others. Indeed, I sense a tipping point may be drawing close.

Q. What has changed since this 2002 analysis to make your lunar mining business case less attractive to investors?

Brad Blair: Lower product price, thus lower revenue as you pointed out in question above about SpaceX’s reduced launch price. Also, the manifold risk elements are becoming more transparent. This second item is good in my opinion because I prefer rationality to ebullience and don’t really like surprises.

Q. For the return trip from GEO to LEO you assume you will be aerobraking. You use 500m/s for this return trip with the aerobraking assumption. But to leave GEO and return to LEO you would first have to do the circularizing burn in reverse (1300-1700m/s) and then you could aerobrake into Earth's atmosphere. If my understanding were correct your analysis would need to add an extra 800-1200m/s for each OTV GEO to LEO trip. Which value do you think is correct?

Brad Blair: Your numbers sound right, but remember I am a mining engineer and an economist by training. Some of our delta-V numbers were guesses. The team lacked an orbital mechanic, so we did the best we could. To the team the most important challenge was to make an end-to-end engineering and economic model that was interconnected – that was our real innovation. By making our assumptions transparent, we knew the model could be updated in the future. The impact of higher delta-Vs is an increase in propellant requirements to deliver the same level of service. This will increase the throughput of the ISRU plant and bump the transport vehicle flight rates somewhat upward as well. In short, it will increase the ops and capital costs somewhat.

Q. What should I have asked you that I did not?

Brad Blair: Lunar dust will be a major issue to overcome. Fortunately it may be susceptible to electrodynamic forces and could therefore be “steered” away from critical systems such as sensors, thermal management surfaces, solar panels and bearing seals. The same challenges will plague surface robotic missions by the way. Early demonstration of mitigation techniques will play a critical role in reducing risk.

Emerging markets (beyond orbital debris as mentioned above) will be another very important consideration for business planning. But that is a separate conversation.

Finally, one of the most important elements of the 2002 study in my opinion was the feasibility conditions that would attract private investment. We changed four primary variables to achieve feasibility. The first variable was ice concentration as discussed above. The second variable was development costs. We dialed those down to zero, assuming that a NASA program would develop ISRU for a human lunar mission and hand the technology to a private operator. This has already started under Constellation. The third assumption was that production costs would be 40% of what NAFCOM said the government would normally pay. An argument can be made that if paperwork and overhead costs can be reduced this may be possible, particularly for a private company. The final assumption was that the market size doubled. This could be achieved by engaging customers in “emerging markets”.

Q: How has your background prepared for this lunar analysis?

Brad Blair: In mid-2003 I was working with a small team of grad students under the leadership of Mike Duke, the director of the CSM Center for Commercial Applications of Combustion in Space or CCACS. Were working for NASA-RASC developing a human ISRU architecture with engineers at JSC, KSC and Glenn. In January of 2004 EV was announced and we were stunned, being the largest academic group actively studying in-situ resource utilization (ISRU) under NASA contract. Most of the team converted to join Lockheed-Martin's team for the CE&R. I left the group to join Raytheon's Senior Advisory Board for their CE&R architecture. We also gave copies of our models to t-Space. Four of the 11 CE&R contractors used ISRU as an element of their lunar architectures (see links below).

Since that time CCACS has changed names to become the CSM Center for Space Resources (CSR) and is now run by Angel Abbud-Madrid. Mike Duke has retired. CSR remains actively involved in NASA and international space agency ISRU programs and enjoys an excellent reputation as an active CSM research arm. While I remain affiliated with the Center, I have gone primarily into consulting since that time.

As a member of the CE&R advisory board to Raytheon I helped bring the ISRU element to their lunar architecture. I also participated in the analysis of related space commercialization opportunities, helping to call a meeting with other CE&R participants to investigate commercial spinoffs enabled by what would become the Constellation program. This meeting directly lead to the formation of the first space investment summit, a project that continues to this day. Finally, in 2005 I helped the Raytheon team pitch the Texas Governor's Economic Development Office on the merits of a Texas-lead commercial LEO propellant depot with the help of the NASA Innovative Partnership Program.

In 2006-2007 I worked for DigitalSpace corporation on SBIRs related to simulating lunar mining and robotic systems using real-time open-source software, and for Bechtel Nevada as a consultant on lunar base simulation and design for NASA-SOMD. I then went underground for about 1 1/2 years, found a private investor, and began developing proprietary technology for the Centennial Challenges program for the power beaming, MoonRox and excavation contests.

The first contest attempt was short lived when my partner Dr. Bernard Eastlund (who holds the patents on the HAARP array in Alaska) passed away. The second shot (MoonROx) ended up developing a lot of IP, but was put on hold for the third contest with the assumption that it would be renewed - so far this has not happened. For the third contest I partnered with a Canadian R&D outfit who raised $250k and built a very sophisticated system for the Lunar Excavation Centennial Challenge. We placed in the contest but did not win. In 2009 I spent a year working with Penguin Automated Systems of Sudbury, Canada writing a report on ISRU for the CSA. My most recent work has been working with a handful of entrepreneurial startup companies and with a law firm that is creating workable solutions for space commerce, governance and property rights.